There’s a new “F-word”…yes, you guessed it – furlough.

What a difference a year makes. Twelve months ago, it is highly likely that the average Brit had never come across the term. However, since the furlough scheme, officially known as the Coronavirus Job Retention Scheme (CJRS) was introduced in March, almost 10 million jobs have been supported.

Equally, since its inception, the scheme has undergone more than one makeover. In fact, it has been extended on no less than three different occasions.

All this can mean that staying up to date with the latest regulations can be extremely complicated.

To help ease the burden and prevent you from hours of unnecessary research, we’ve decided to produce this short article that contains all of the latest rules and regulations relating to the furlough scheme.

Who is eligible for the CJRS?

Employers

All employers with a UK bank account and UK PAYE schemes can claim for the grant. The employer does not have to have previously used the CJRS to be eligible.

Employees

To be eligible for the CJRS, employees must have been on an employer’s PAYE payroll on October 30, 2020. This means that an RTI submission for that employee must have been made between March and before October 30, 2020.

Employees can be furloughed regardless of whether they have or have not been previously furloughed. If an employee is being furloughed for the first time and was not employed on March 19 2020, the updated calculations and reference period must be used.

For fixed salary employees this will mean 80% of the wages payable in the last pay period ending on or before October 30. Those on variable pay will receive 80% of the average payable between the start date of their employment or, April 6, whichever is later, and the day before their extension furlough period begins.

Any employee who has been previously furloughed, or has been employed since March 19 2020, will have their pay calculated based on the previous pay reference period. For fixed salary employees, this will relate to 80% of the last pay period ending on or before March 19.

All employees on variable pay will be eligible to receive the higher of either 80% of the wages earned in the corresponding calendar period in the tax year 2019 to 2020 or, the average wages payable in the tax year 2019/20.

Employees on all types of contract are eligible and employers will need to agree to any working arrangements with employees.

Those who are shielding or live with someone who is shielding are eligible, as is anyone who has caring responsibilities as a result of coronavirus.

Timeline of the furlough scheme

March 2020

CJRS launched on March 20 and backdated to March 1. Government contributions begin at 80% of a furloughed employees’ wage, capped at £2,500 per month. Government contributions include employer National Insurance (NI) and pension contributions. The CJRS is initially planned to last just four months – March to June.

May 2020

On May 12, the Government announces that the CJRS will be extended until the end of October; however, it is also announced that the Government contributions will decrease month-on-month from August. Finally, it is confirmed that companies will be unable to furlough an employee for the first time beyond June 10.

July 2020

Flexible furloughing is introduced from the start of July. Furloughed employees are allowed to return to work on a part-time basis; however, employers become responsible for paying the entirety of an employee’s wage for the hours they work. The Government contribution remains at 80% for all unworked hours.

August 2020

Employers are required to begin paying the NI and pension contributions for furloughed employees. The Government continues to pay 80% of a furloughed employee’s wage.

September 2020

The Government’s wage contribution is reduced to 70% and employers have to pay 10% of their furloughed employees’ wage to meet the minimum 80% mark.

October 2020

The wage contribution is reduced again, this time to 60%. Employers must now contribute a minimum of 20% of furloughed employees’ wages.

November 2020

On October 31, the day the CJRS was due to end, Prime Minister Boris Johnson announces that it will be extended until December. The Government contribution returns to 80% (capped at £2,500 per month); however, employers remain responsible for NI and pension contributions. It is also announced that employees, for the first time since mid-June, can be furloughed for the first time.

November 5, 2020

Chancellor Rishi Sunak announces on November 5 that the furlough scheme will be extended until the end of March.

December 17, 2020

Chancellor Rishi Sunak announces that the furlough scheme will be extended for a further month until the end of April 2021.

Flexible furlough

Under flexible furlough, employers can only claim for the hours that an employee does not work. The claimable amount can be calculated by reference to their usual working hours in a claim period. Naturally, employers will be responsible for paying employees for all hours worked.

Employer furlough grant claims should cover a minimum period of seven consecutive calendar days. Employers will need to report the hours worked and the usual hours an employee would be expected to work in a claim period to HMRC.

Employers remain entitled to top-up employee wages should they wish.

“During Covid PayFit reacted quickly to new rules and went above and beyond to make sure our payroll would run on time. It was during this time I discovered I’d been recording holiday the wrong way in the app, which meant the pay totals were wrong for furlough. PayFit support helped identify this, worked out how to resolve it and then did the corrections for me. Truly first class payroll software.”

Steve Root, Partner @ Roots Kitchens Bedrooms Bathrooms

Can employees that have been made redundant be brought back?

An employee who has been made redundant or stopped working is able to be re-employed and placed on furlough provided that they meet one of two conditions:

- the employee was on an employer’s payroll on September 23 and a PAYE Real Time Information (RTI) submission including them, was sent on or before this date;

- they were made redundant or stopped working for their company on or after September 23.

How does an employer claim?

Employers will need their Government Gateway user ID and password they got when they registered for PAYE online.

They can claim before, during or after they process their payroll as long as the claim is submitted by the relevant claim deadline. They are not allowed to claim more than 14 days before the claim period end date.

When making a claim an employer:

- does not have to wait until the end date of the claim period for a previous claim before making their next claim

- can make a claim more than 14 days in advance of the pay date – e.g. if an employer pays their employees in arrears

If an employer does not finish their claim in one session, they are able to save it as a draft. However, an employer must complete their claim within seven days of starting it.

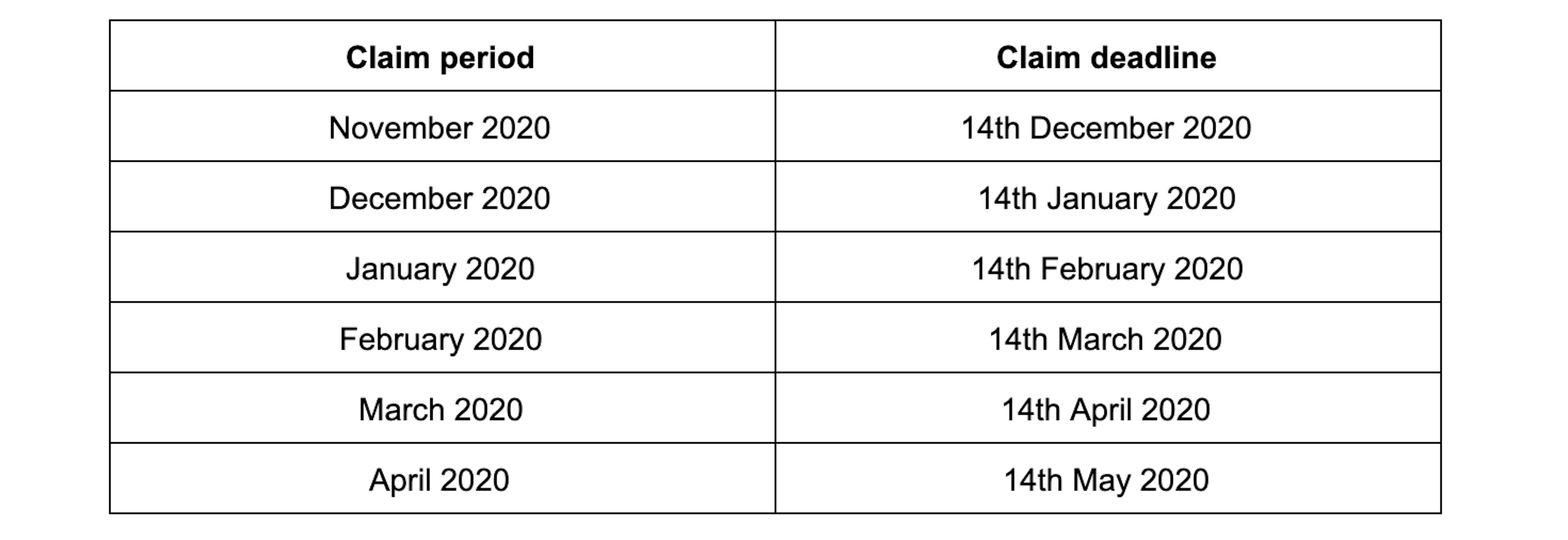

Claims must be submitted by 11.59pm, 14 calendar days after the month being claimed for. If this time falls on a weekend or bank holiday then claims should be submitted on the next working day.

Furlough claim period dates.

If an employers wants to delete a claim in the online service, they must do so within 72 hours of starting it.

Unsure about furlough or concerned that your current payroll provider is not able to meet your demands?

Book a demo with one of our product specialists today.

This post was written by PayFit website here. They are an exhibitor on the HRTech247 Payroll, Time & Attendance floor here.